Which riskier low PE or high PE stocks market crash? Explore historical data and key insights to protect your portfolio in tough times.

Let me set the stage for you. It is late 2008, and the world financial markets are plummeting. Panic is everywhere; your neighbor suddenly appears to know more about recessions than you do, your portfolio seems to have taken on more of a roller coaster appearance instead of a solid investment, and you’re saying to yourself, “How do I protect what is left of my investments?” And that’s exactly how I felt.

Equipped with spreadsheets, late-night coffee, and too many tabs open about market analysis and risk assessment in stocks, I plunged into the question probably bringing you here today: are low P/E stocks riskier in a market crash than high P/E stocks?

This article delves deep into that very dilemma. We shall break it down, go through historical data, and most importantly, look to aid in making informed decisions as regards one’s portfolio.

Article Breakdown

What does the P/E Ratio tell us about Risk?

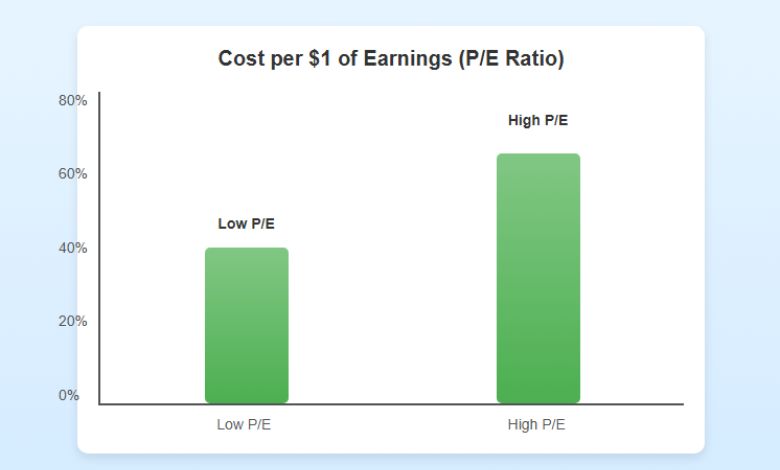

Before we get into the “low vs. high” debate, let’s take a brief look at what the P/E actually is. In layman’s terms, it’s how much you’re paying for $1 of the company’s earnings.

- Low P/E stocks: They are like finding that gem in a thrift store-very good value. You pay less for the earnings of the company, and they are considered undervalued or steady performers. Think utilities or strong industrial companies.

- High-P/E Stocks: These would be the designer brands. Here, investors will pay extra dollars for companies perceived to grow phenomenally-that is how disruptors, tech stocks, and innovators can get a huge price tag set on their stock prices.

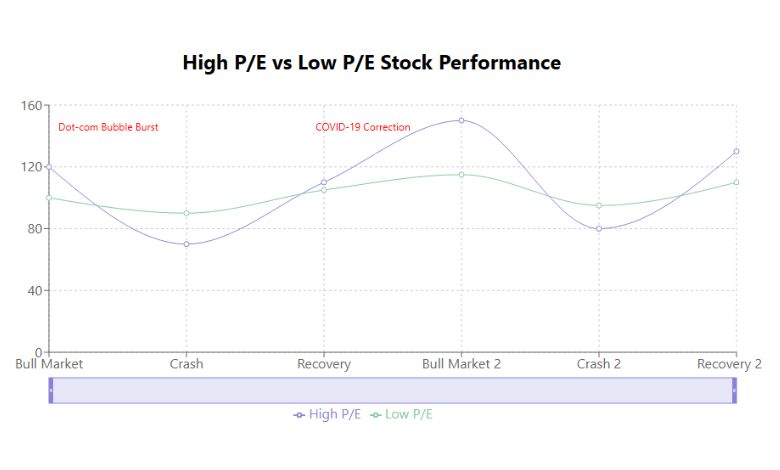

When the market is hot, high P/E stocks are the rockstars: all high on optimism and promise. But when the market crashes? That’s where things get dicey.

Why Low P/E Stocks May Be Safer in a Market Crash

Let’s start with the low P/E stocks. During a market downturn, these companies tend to hold their ground better. Why? Because they’re often backed by strong fundamentals and steady earnings. Let’s break this down:

1. Historical Outperformance

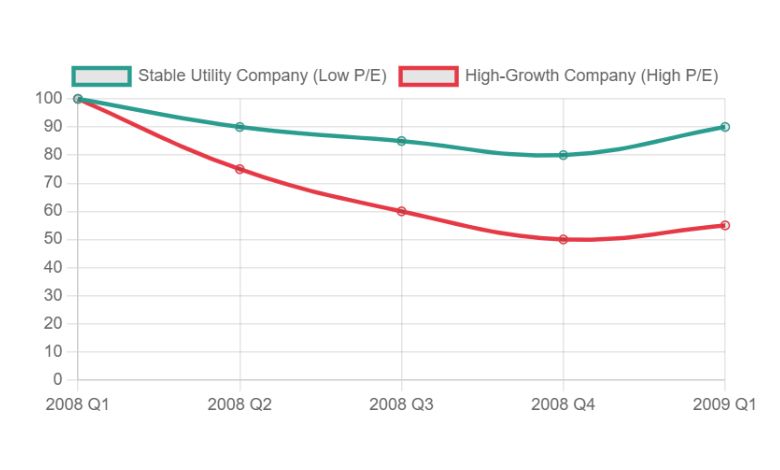

Low P/E stocks have historically outperformed high P/E stocks during market crashes. During the 2008 financial crisis, for example, the Russell 2000 Value Index (dominated by low P/E stocks) fell 37%, compared to the Russell 2000 Growth Index (dominated by high P/E stocks), which dropped 45%. That’s a big difference when you’re watching your portfolio shrink.

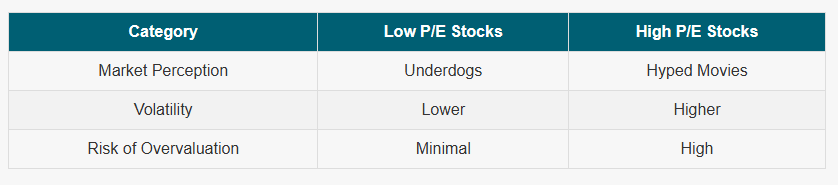

2. Lower Expectations = Smaller Falls

Here’s an analogy: Imagine you’re watching a movie that’s been hyped as the “greatest film ever made.” If it’s even slightly underwhelming, you’re disappointed. High P/E stocks are like that, they have to deliver big, or the market punishes them. Low P/E stocks, on the other hand, are the underdogs. Expectations are already modest, so they don’t have as far to fall.

3. Intrinsic Value Stays Intact

Even during a crash, the intrinsic value of a low P/E stock remains relatively stable. For example, a utility company with a consistent cash flow might see its stock price drop temporarily, but its fundamental value, based on stable earnings, doesn’t change as dramatically. This makes it easier for these stocks to recover post-crash.

Why High P/E Stocks Are Riskier in Downturns

On the flip side, high P/E stocks are like the sprinters of the stock market. They’re fast, flashy, and can generate incredible returns in a bull market. But in a crash? They’re the first to stumble. Here’s why:

1. Overvaluation Comes Back to Bite

When the market is booming, high P/E stocks thrive on optimism. Investors pay a premium for potential future growth. But during a crash, that optimism disappears overnight. Valuations get slashed, and high P/E stocks feel the pain first. For instance, during the dot-com bubble burst in the early 2000s, high P/E tech stocks like Cisco and Pets.com saw their valuations obliterated, dropping by over 70% in some cases.

2. Earnings Volatility

High P/E stocks often represent growth companies, which reinvest earnings rather than banking on steady profits. When a crash hits, these companies face tighter credit conditions, declining revenues, and increased investor scrutiny. This makes them vulnerable to drastic revaluations.

3. Momentum Can Work Against Them

High P/E stocks often rely on momentum. As soon as fear creeps into the market, momentum reverses, and these stocks nosedive. The sharp sell-offs in companies like Tesla or Zoom during market corrections are examples of how quickly sentiment can shift.

How I Learned the Power of Diversifying Between High and Low P/E Stocks

I’ll admit, I’ve been guilty of chasing high P/E stocks during bull markets. Who doesn’t want to invest in the next big thing? I remember buying a high-flying tech stock in 2019. It had a P/E ratio north of 80. Things were great, until 2020 hit and the market wobbled. That stock? It dropped nearly 50%, and I was left questioning my strategy.

In contrast, my investment in a low P/E industrial company at the same time? It barely budged during the downturn and actually gained value in the recovery. That’s when it clicked for me: diversification between low and high P/E stocks is critical.

Actionable Strategies to Navigate a Market Crash

Now that we’ve explored the risks, let’s talk about solutions. When a market crash looms, here’s how you can position your portfolio to weather the storm:

1. Diversify Your Portfolio

Don’t put all your eggs in one basket. By balancing low and high P/E stocks, you can capture the growth potential of high P/E stocks while leaning on the stability of low P/E stocks. For example, pairing a tech giant like Apple (high P/E) with a utility company like Duke Energy (low P/E) can create a more balanced portfolio.

2. Focus on Quality Companies

During a crash, quality matters more than ever. Look for companies with:

- Strong balance sheets

- Consistent earnings

- Low debt levels

These are the stocks that are more likely to survive and thrive in the long run.

3. Use Valuation Metrics Wisely

P/E ratios are just one tool. Combine them with other valuation metrics like price-to-book (P/B) and price-to-sales (P/S) to get a more comprehensive picture of a company’s value.

4. Embrace Dollar-Cost Averaging

When the market crashes, panic selling is tempting. Instead, consider dollar-cost averaging, investing a fixed amount at regular intervals. This approach helps you buy more shares when prices are low and reduces the risk of mistiming the market.

5. Keep Cash Ready

Market crashes present opportunities to buy great stocks at discounted prices. Having cash on hand lets you act decisively when opportunities arise.

Key Takeaways for Investors

Let’s wrap this up with some concise, actionable takeaways:

- Low P/E Stocks are generally safer during market crashes due to lower expectations and intrinsic value stability.

- High P/E Stocks offer growth potential but are more vulnerable to sharp declines during downturns.

- Diversification is your best friend. Balance growth with stability to protect your portfolio.

- Focus on Fundamentals when evaluating any stock, especially in uncertain markets.

- Stay Calm and Strategic during crashes. Emotional decisions rarely lead to good outcomes.

Useful Articles:

- Portfolio diversification: What it is and how it works: Discover the power of diversification and explore investment strategies that spread risk and enhance your portfolio’s resilience.

- 6 Ways to Prepare for a Market Crash: Learn essential strategies to shield your investments from severe market downturns, with diversification as a key component.

- P/E Ratio: Why Investors Need Better Stock Valuation: Understand why low P/E stocks can be advantageous, offering more earnings for your investment and potential undervaluation benefits.

- 4 Low P/CF Stocks to Turn Market Volatility Into Opportunity: Explore how low P/CF stocks can be a strategic choice during volatile markets, providing robust earnings growth at a lower cost.