Discover how same day pre-settlement loans can offer immediate financial relief during legal challenges and regain control of your situation.

Unexpected obstacles abound in life, and I discovered this myself during a very turbulent period.

Imagine yourself in the middle of a case, nervously waiting for your payout, when all of a sudden you are struck with a slew of unanticipated costs leaving you broke.

That was a time when I felt as though the ground was underneath and I was in a whirlpool of doubt.

Having worked in the legal and financial sectors for years, I understood the stakes were high and the pressure was growing, particularly with relation to handling business debt.

During this turbulent time, I came upon the idea of “same day pre-settlement loans,” a financial lifeline with instant relief capacity.

Looking back on my personal experience, I can boldly state that knowing these loans were indispensable not only for negotiating my financial difficulties, including business debt, but also for restoring control over my circumstances.

I grew to see that many others, particularly those in like circumstances, may gain from this information.

By offering my observations, I hope to give anyone caught in the whirlpool of legal and financial obstacles direction and help.

Let’s dive in.

Article Breakdown

What Are Same Day Pre-Settlement Loans?

Basically, same day pre-settlement loans are cash advances against the possible resolution of your continuing lawsuit.

Designed to give plaintiffs instant financial relief, they let them meet necessary costs while they wait for their claims to be resolved.

Pre-settlement loans are non-recourse advances unlike standard loans, which call for credit checks and monthly payments. This implies that only in case you win your case will you be reimbursed the loan.

For borrowers, this special characteristic significantly lowers the financial risk.

Benefits of Same Day Pre-Settlement Loans

Using their savings, almost 44% of Americans find they cannot meet an unplanned $1,000 bill.

This is a depressing figure that emphasizes the need for having emergency money available in hard times financially.

Same day pre-settlement loans give a remedy by giving quick financial help without increasing your already high stress.

These loans have some main benefits as follows:

Easy Fund Access: Get Paid Within Hours after Approval

Same day pre-settlement loans’ quickness is among its most important advantages. Usually quick, the process lets you get money hours after approval.

I remember one instance when an unanticipated medical bill arrived at my house and the obvious concern. My saving grace was a pre-settlement loan, which almost instantly supplied the required money and released that weight from my life.

No Credit Check Needed: Your Eligibility Is Unaffected by Your Credit History

Many times depending on credit scores, traditional loans can be problematic. Pre-settlement loans, however, do not call for a credit check. The only thing under discussion is the strengths of your argument.

This can be a game-changer, particularly if your credit record isn’t perfect, letting you get the money you need free from credit rejection headaches.

No Monthly Payments or Upfront Fees: Maintaining Your Cash Flow Integrity Without Hidden Expenses

Control of cash flow during litigation might be difficult. By removing upfront costs or monthly payments, pre-settlement loans provide a respite.

During my instance, this was very beneficial since it allowed me to concentrate on current needs free from concern for additional debt.

Non-Recourse Advances: Minimise Financial Risk by Repayment Only If Your Case Wins

Non-recourse advances have the attractiveness in that repayment depends on winning your case. This tool reduces financial risk so that, should the result not be in your advantage, you are free from debt.

In an otherwise unclear context, this is a consoling idea that helps you gain peace of mind along your legal path.

Comparison of Pre-Settlement Loans with Other Financing Options

Comparatively analyzing pre-settlement loans with different financial choices helps one really assess their worth.

I have included some salient contrasts down below:

| Financing Options | Same Day Pre-Settlement Loans | Traditional Loans | Credit Cards |

| Eligibility Criteria | Merits of your case | Credit score, income, collateral | Credit score |

| Upfront Fees/Interest Rates | Varies by lender and case details, typically between 2-4% per month | Fixed interest rates and fees | Variable interest rates and fees |

| Monthly Payments | No | Yes | Yes |

| Repayment Contingent on Case Outcome | Yes | No | No |

This analogy makes it abundantly evident that pre-settlement loans provide a special financial option during legal disputes. Compared to other choices, they provide low financial risk, fast access to money, and no monthly payments or upfront costs.

How Do Same Day Pre-Settlement Loans Work?

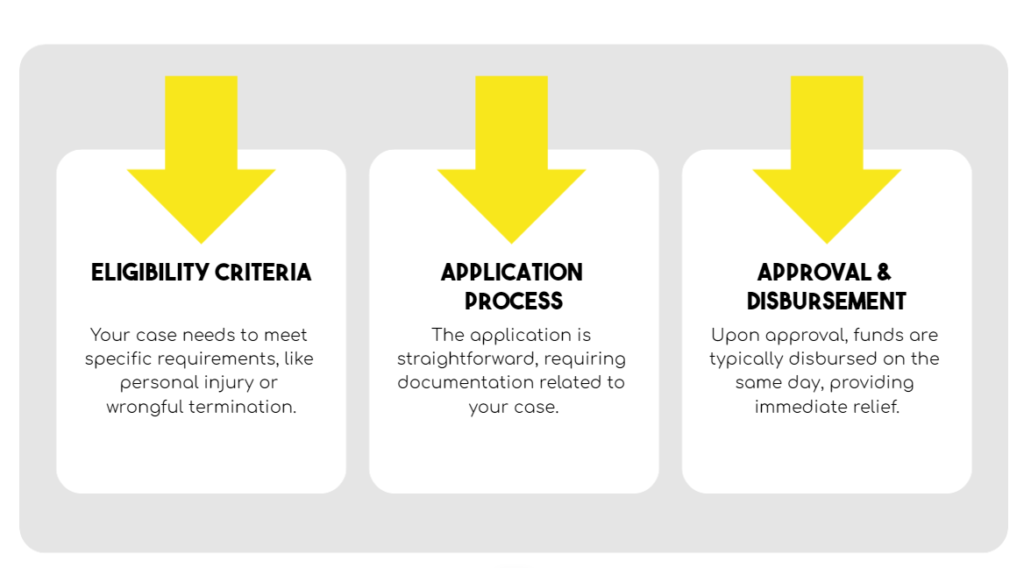

Eligibility Criteria

Your case must satisfy particular requirements if you are eligible for same day pre-settlement financing. Usually eligible are bodily injury cases, wrongful termination, or other civil lawsuits.

This useful table summarizes possible credentials:

| Case Type | Minimum Requirements |

| Personal Injury | Valid insurance claim |

| Wrongful Termination | Active lawsuit |

| Medical Malpractice | Evidence of negligence |

Application Process

Applying for a pre-settlement loan normally is easy. You will have to send material pertaining to your situation, such as medical records or legal documents. Before continuing, the lender will assess the strength of your case. Haute!

Approval and Disbursement

Once authorized, money usually comes out the same day. My experience tells me the procedure was quite flawless. Having the money sent straight to my account helped right away during a trying time. What a consoling feeling of tranquility it generates.

A same-day pre-settlement loan can assist you with covering these immediate costs.

A Same Day Pre-Settlement Loan Can Help You Cover These Urgent Expenses

Everybody knows that a lawsuit does not stop life. Emergencies develop and bills mount up.

While you wait for your case to be resolved, a same day pre-settlement loan might help pay for these pressing expenses.

These are some typical urgent costs:

Other Pre-Settlement Loan Alternatives When Your Case Is Weak

I understand personally how intimidating court cases can be. Cases may not go as expected, even with solid proof and a reputed attorney.

Should your case be weak, you still have choices for financial help:

1. Post-Settlement Loans

Post-settlement loans are offered following lawsuit settlement. These loans are easier to get since the outcome of your case is already known.

2) Legal Funding

Legal finance offers upfront cash in exchange for a percentage of potential earnings if your case is successful.

3. Personal Loans from Local Credit Unions or Banks

Your credit history and financial situation will determine if you’re qualified for a personal loan from a credit union or bank.

4) Advance Legal Fee Payments from Your Attorney

Your attorney might be ready to pay advance legal fees, depending on personal agreements.

5. Structured Payment Schedules with Creditors and Healthcare Providers

Structured payment plans allow you to pay smaller, more reasonable amounts over time.

6. Credit Cards with Zero-Interest Intro Offers

If your credit score is respectable, you might qualify for a credit card with zero-interest promotional offers.

7. Peer-to-Peer Lending via Platforms like LendingClub and Prosper

Platforms like LendingClub and Prosper offer peer-to-peer lending alternatives.

8. Emergency Funds in a High-Yield Savings Account

If you have an emergency fund, consider using it to cover pressing needs instead of borrowing money.

Frequently Asked Questions (FAQs)

1) Can I apply for a pre-settlement loan if my case is ongoing?

Yes, provided your case satisfies lender requirements.

2) How much can I borrow with a pre-settlement loan?

The amount depends on your case’s predicted settlement and the lender’s policies.

3) What happens if I lose my case?

Usually, non-recourse loans mean that, should you lose, you will repay nothing.

4) Are there any fees associated with pre-settlement loans?

Some lenders levy fees, so it’s crucial to state terms clearly up front.

Key Takings

- Facing court battles can be emotionally and financially taxing.

- Pre-settlement loans provide immediate access to money without monthly payments or upfront costs, offering relief.

- By means of non-recourse advances, they also reduce financial risk.

- Pre-settlement loans are worth considering when weighing your options for financial help during litigation.