Discover what is FPB credit report, its significance, and how it impacts your financial health in our comprehensive guide.

Having navigated the complexity of personal finance for years, I frequently receive questions about the nuances of credit reports.

One especially common question is, “What Is FPB Credit Report?”

For me, this question is quite relevant since I clearly recall my first interaction with my personal credit report.

I made the decision to start controlling my financial future on a wet afternoon. Equipped with a cup of coffee and a will to know my credit situation, I retrieved my FPB Credit Report online.

At first, the sheer amount of material was daunting, but as I dug further, I started to appreciate the importance of every element.

I discovered that my credit score was much influenced by my payment history, existing debt, and even the credit types I utilized.

This encounter opened my eyes not only to the immediate knowledge I discovered but also to the importance of being proactive about my finances.

Knowing “What Is FPB Credit Report” has helped me make wise decisions about loans, terms of negotiation with creditors, or business credit card choices.

Along this road, I have grown enthusiastic about teaching others on this subject and am ready to impart the knowledge that will enable them to reach financial success and security.

Let’s dive in.

Article Breakdown

What is an FPB Credit Report?

Fundamentally, the FPB Credit Report is a comprehensive narrative of your credit record supplied by the Federal Public Bureau (FPB).

Like me, when I first learned about a credit report, I thought it was merely a number. Actually, it is far more thorough. It covers your past and present credit accounts, payment record, outstanding balances, and credit inquiries you have made.

Consider it your financial behavior’s equivalent of a report card. And, like in the classroom, a strong report card can open doors to improved prospects.

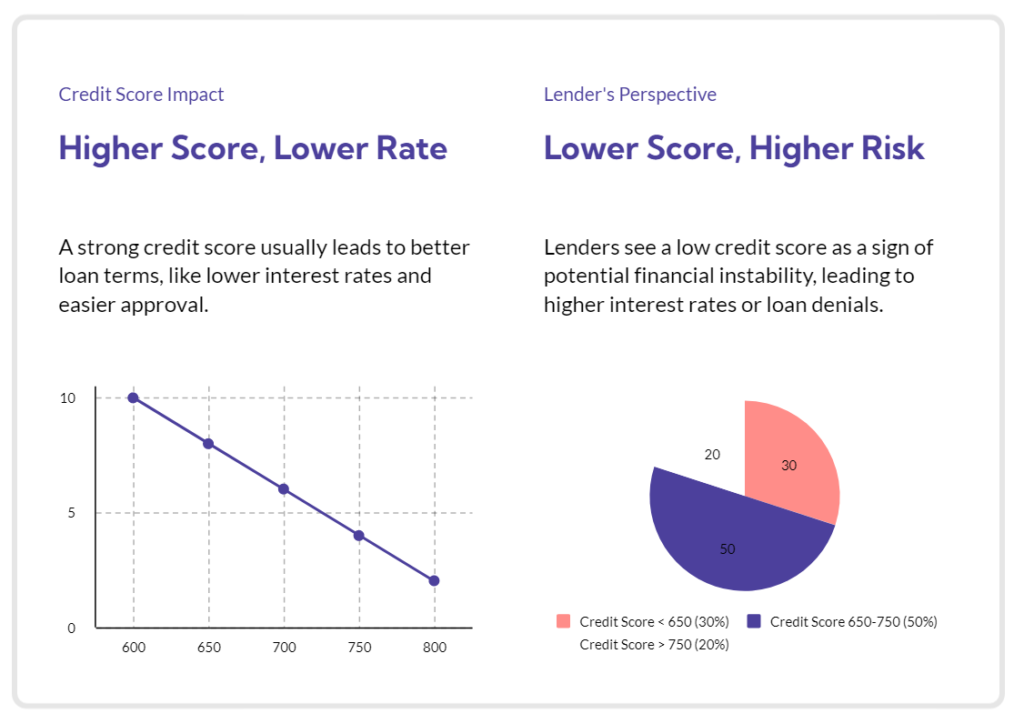

How Does an FPB Credit Report Affect Loan Approval and Interest Rates?

Let us now address why this is important.

Applying for credit cards or loans depends greatly on your FPB Credit Report.

Lenders evaluate your creditworthiness using this report.

I still recall asking for my first auto loan.

Painted on pins and needles, I hoped my credit report would not throw any curveballs.

As it turns out, it did.

A few late payments on a department store card almost sent the procedure off course.

Therefore, a good FPB Credit Report not only ensures your approval but also guarantees more reasonable interest rates, thereby saving money over time.

Steps to Obtain Your FPB Credit Report

Obtaining your FPB Credit Report is easier than you might believe.

Here is a step-by-step guide:

From personal experience, getting my credit report was quick, like opening a treasure box of financial habit analysis.

Interpreting Your FPB Credit Report: Key Components to Look For

Now that you have your report, let’s go through what to look for:

Financial History

Your payment history is a record of your regular bill payment consistency. During college, I had a run of late payments that lingered on my credit record for years. It’s essential to maintain this cleanliness.

Account Types

Your credit mix—which could include credit cards, mortgages, and installment loans—is described in this section. Though a varied combination can be good, remember that quality comes before quantity.

Ratio of Credit Utilization

What percentage of your credit limit are you currently utilizing? Try to keep this under 30%. Maxing out my credit cards turned out not to be a good look, as I learned the hard way.

Credit History Term

Better still is your credit history length. It improves with age, like a good wine. Though it’s a relic from my college years, my first credit card still boosts my score.

New Credit Investigations

Every credit application you submit shows as an inquiry. Too many could raise concerns for lenders. I once applied for multiple credit lines quickly and experienced this lesson firsthand.

Negative Details

This covers items like liens, foreclosures, and bankruptcies. Understanding these elements is crucial since they greatly affect your score.

Improving Your FPB Credit Score: Tips and Strategies

One-third of Americans have credit report errors. Should you find any mistakes, make sure you contest them immediately with the FPB.

Raising your credit score is like getting in shape. It requires consistent work and patience. Here are a few tactics:

Making Timely Payments

To ensure you never miss a due date, schedule reminders or automatic payments. Being proactive about this helps avoid headaches down the road.

Reducing Debt and Maintaining a Low Credit Utilization Ratio

Try to pay off your current debt and avoid taking on new ones. When I prioritized paying off my credit card debt, my score began to rise steadily.

Avoiding New Credit Inquiries

Unless absolutely necessary, try not to apply for new credit. After college, I started choosing credit cards more carefully.

Disputing Incorrect Information

Review your report for any errors and challenge them promptly. It’s like editing a crucial piece of work—you want it to be flawless.

Frequently Asked Questions (FAQs)

1) What Is FPB Credit Report Mean?

The Federal Public Bureau’s FPB Credit Report provides a complete view of your credit history.

2) What Is FPB On Credit Report?

FPB stands for the Federal Public Bureau, the agency responsible for creating your credit report.

3) What Is FPB Suspended On Credit Report?

If you find “suspended” linked with FPB on your report, this may indicate a temporary halt in credit activity, likely due to a dispute or investigation.

4) What Is FPB Credit Card Internet?

This term typically relates to online transactions or managing your FPB credit card.

5) What Is FPB Cr Card Internet Charge?

These are charges made with your FPB credit card from internet transactions.

6) Is FPB Cr Card Internet And FPB Credit Card Same?

Yes, they refer to the same credit card but highlight different features or uses.

Key Takings

- Knowing your FPB Credit Report is about more than numbers—it’s about taking control of your financial future.

- By understanding the elements of your report and working to improve your credit score, you open the door to better financial opportunities.

- Remember, this journey is like climbing a mountain.

- Though the climb may be steep and challenging, the view from the top is well worth the effort.