Find out what is business debt schedule and the essentials of a business debt schedule in our comprehensive 2024 guide.

Dealing with money was always one of the biggest challenges an entrepreneur faced running his company.

Early on, I felt as if I was juggling several loans, credit lines, and payment plans all the time.

One could easily feel overwhelmed, particularly in times of limited cash flow when every cent counted.

That’s when I realized a business debt schedule had worth.

Early on in my path, I ran across Sarah, another entrepreneur, at a local networking function.

Her records were unorganized, so she told me she almost missed a payment.

Sarah described how using a basic tool—a company debt schedule—changed her attitude about handling money.

Curious, I decided to design my own version of this calendar.

It was about grasping and managing my financial obligations, not only about enumerating debt.

Having a business debt schedule, I could immediately find my whole debt, the interest rates on different loans, and when payments were due.

This instrument proved indispensable for long-term planning and expansion as well as for daily activities.

This tutorial will teach you what a business debt schedule is, why it’s crucial, and how to design one to provide your financial management peace of mind and order.

Let’s dive in.

Article Breakdown

What Is a Business Debt Schedule?

A business debt schedule is a comprehensive record of every outstanding business debt. This covers particulars including each debt’s amount owed, interest rates, maturity dates, and terms of repayment. Basically, it offers a moment of view of the company’s obligations at any one moment, thereby enabling management and stakeholders to plan appropriately based on the whole debt load.

A recent Small Business Administration survey indicates that seventy percent of American small firms have some kind of debt to help with running their operations.

By means of a well-organized plan, appropriate debt management helps companies avoid risks and maximize their financial policies for long-term success.

A debt schedule is a financial planning instrument that lets companies methodically monitor their debt commitments. Usually it features a list of all the loans, bonds, and other kinds of debt together with relevant information about each. This calendar helps with cash flow projections, debt management, and evaluation of how debt affects corporate financial situation.

Key Elements of a Business Debt Schedule

An all-encompassing debt schedule should incorporate several essential elements to be successful:

- Creditor Information: The lender’s or creditor’s name.

- Principal Amount: The debt or loan’s starting value.

- Remaining Balance: The balance left to be paid is outstanding.

- Interest Rate: The debt’s charged rate of interest.

- Repayment Terms: Whether monthly, quarterly, or otherwise the debt must be paid back following these guidelines.

- Maturity Date: The date the debt has to be completely paid back.

- Collateral: Any item promised to be loan security.

- Payment Schedule: Complete analysis of due dates and payment amounts.

Business Debt Schedule Example

To illustrate, let’s consider a business debt schedule example for a hypothetical company:

| Creditor | Principal Amount | Outstanding Balance | Interest Rate | Repayment Terms | Maturity Date | Collateral | Payment Schedule |

| Bank A | $500,000 | $300,000 | 5% | Monthly | 31-Dec-2025 | Equipment | $10,000/month |

| Lender B | $200,000 | $150,000 | 4% | Quarterly | 30-June-2023 | Inventory | $50,000/quarter |

| Bondholders | $1,000,000 | $1,000,000 | 3% | Annual | 01-Jan-2030 |

This table provides a clear overview of the company’s debts, allowing for better financial planning and decision-making.

Importance of a Business Debt Schedule

Helping with Financial Planning

Financial planning depends much on a schedule of debts since it shows a company’s obligations in a clear perspective. Knowing their whole debt load helps companies decide how much to borrow, invest, and pay for running expenses.

Enhancement of Cash Flow Management

Business debt schedules enable companies to predict future debt payback cash flow needs. This guarantees that they may save enough money to cover their needs without endangering daily operations.

Evaluating Financial Health

Stakeholders can evaluate the financial situation of the business by means of a well-maintained debt schedule. It aids the computation of several debt ratios, including debt-to-equity ratio, debt burden ratio, and debt service coverage ratio.

What Is Debt Burden Ratio?

A company’s debt burden ratio is a financial measurement of its whole debt against its whole revenue or assets. It offers understanding of the degree of leverage and the debt load of the business related risk.

Debt Burden Ratio Meaning

The debt burden ratio indicates whether a corporation has too much debt in relation to its income or assets, therefore defining their meaning. A high debt load ratio points to more financial risk and possible problems fulfilling debt commitments. On the other hand, a low ratio denotes a more under control debt level.

Calculating Debt Ratios

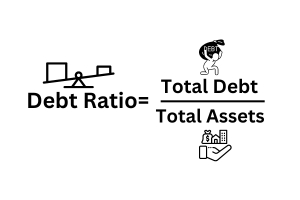

To calculate debt ratio, you can use the following formula:

What Is a Good Debt Ratio?

One should understand that the sector influences the appropriate debt ratio. Generally speaking, however, a debt ratio less than 0.5 is viewed as good as less than half of the company’s assets are financed by debt. Especially if they exceed industry averages, ratios above 0.5 can point to increased financial risk.

Business Debt vs. Personal Debt

Crucially, one must know the difference between personal and corporate debts. Business debt is the liabilities a company bears to support its operations, growth, or other activities. Personal debt, on the other hand, relates to liabilities assumed by people for personal consumption including credit cards, mortgages, and personal loans.

Key Differences

- While personal debt is for personal consumption, business debt funds company operations.

- Though personal loan interest usually is not tax-deductible, business debt interest is often.

- Risk: Personal debt influences personal budgets and credit scores; business debt adds operational dangers.

Strategies for Managing Debts

Effective management of debts for business involves several strategies:

- Combining several loans into one helps to streamline payments and maybe guarantee better terms.

- Replacing current debt with new debt under more advantageous terms or reduced interest rates is known as refinancing.

- Negotiating with creditors to change loan terms in instances of financial difficulty is known as debt restructuring.

Monitoring Debt Levels

Essential are regular updates of the business debt schedule and debt level monitoring. This guarantees that the business can satisfy its liabilities without too much impact on cash flow and stays within reasonable debt ratios.

Fostering Lifelong Learning

Managing and understanding commercial debt is a constant exercise. Working with financial advisers, going to seminars, and applying financial management tools will help you to improve in this field. Through constant learning and adaptation, companies can more successfully negotiate debt management complexity.

Final Thoughts

When one considers the need of controlling firm debt, it is evident that good financial planning and cash flow management depend on a complete debt schedule. Maintaining thorough records of creditor information, principal amounts, and loan terms helps me to project future responsibilities and guide borrowing and investment decisions. Knowing numbers like the debt load ratio helps me evaluate the financial situation of my company; meanwhile, techniques like consolidation and refinancing provide means of more effectively managing debt. Frequent debt schedule updates and embracing lifelong learning guarantees me to remain proactive in managing debt, therefore strengthening the financial base of my business.

Frequently Asked Questions (FAQs)

1) What is debt scheduling?

Organizing and controlling a company’s debts helps to maximize cash flow, track financial situation, and support decision-making by means of debt scheduling.

2) What is the debt service schedule?

Comprising principal and interest, the debt service schedule is a table showing the frequency and amounts of regular debt installments.

3) What is the business debt schedule?

A business debt schedule is an all-encompassing breakdown of a company’s debt containing loan specifics, payment periods, and outstanding sums. It enables companies to properly track and control their liabilities.

4) What is company debt structure?

The arrangement of a company’s debts—including kinds of debt, maturity dates, and interest rates—is known as the firm debt structure. Good debt management depends on a knowledge of this framework.

5) How often should businesses update their debt schedule?

Companies should strive to update their debt schedules at least once every three months or whenever their borrowing activity shows notable changes. For financial planning and decision-making, regular updates assist guarantee correct and current knowledge.