Learn how to find who is charging on your credit card with these simple steps to protect your finances and stay informed.

It came as a surprise, coupled with lots of concern, when I saw some charge on my credit card that looked unfamiliar on the statement.

As someone who meticulously tracks my financial transactions, the presence of an unrecognized expense was baffling, yet it was a challenge I was determined to unravel.

Therefore, being in a position to recognize and handle these unauthorized charges is an acquired skill, especially when digital transactions are becoming the norm, and personal data has an increasingly high chance of exposure.

My journey through this confusing case provided invaluable lessons in the way credit card security and fraud prevention are set up.

Painstakingly, I came up with a step-by-step process utilizing my financial knowledge and extensive research toward the source of these charges, while also strengthening my credit card against future breaches.

This experience reinforced my knowledge of financial literacy and gave me the authority to continue helping others through similar problems.

Let’s get started.

Article Breakdown

Credit Card Charges and Fraud

At one point or another, most of us have looked at our credit statement and wondered: “What is this charge on my credit card?”

It’s a common scenario, especially with the rise of online shopping and subscription services.

Everything from a tiny, unnoticeable charge to an amount that can wreck your budget falls under credit card fraud.

Your first line of defense is to understand the nature of these charges, and how they occur.

Credit card fraud tends to occur when your card details fall into the wrong hands.

This could happen through phishing, leakage due to data breaches, or even misplacing your card.

Scammers may initiate a meager and almost insignificant charge to test the waters before making big transactions.

Being proactive with your transaction monitoring can enable you to track this type of activity early on.

Step-by-Step Guide: How to Find Who Is Charging on Your Credit Card

Step 1: Review Your Recent Purchases

A good way to start detecting unknown charges on your credit card is by having a close look at recent purchases.

It’s possible you made this purchase unconsciously, or that it was made by an authorized user of your account.

Be sure to check for any subscription services or automatic payments that may have been charged.

It is a good idea to check your credit card statement each month.

If you find some charges that look unfamiliar, don’t freak out just yet; follow the subsequent steps to determine whether it’s fraud or not.

Step 2: Monitor Your Account Regularly

Make it a habit to frequently log into the bank apps or website.

I once caught a fraudulent transaction simply because I checked my account during a lunch break.

Regular monitoring will help you to find discrepancies at an earlier stage rather than a later one.

Step 3: Set Up Transaction Alerts

Most banks offer transaction alerts that can notify you of any activity on your account—a purchase, withdrawal, or transfer.

You can have these alerts emailed or texted to you, and they help keep you on top of your finances.

Set up alerts for each transaction type, and customize them the way you want.

This has been a lifesaver for me.

For any charge that is more than the normal amount, I get an immediate notification. This way, you can immediately verify the transaction and, if necessary, take quick action.

Step 4: Use Your Card’s Security Features

Many reputable card companies offer additional security features, such as virtual card numbers and spending limits.

Virtual card numbers let you generate another number for each online transaction, making it harder for fraudsters to steal your information.

Setting a spending limit helps avoid large unauthorized transactions.

If you find a charge that exceeds your set limit, notify your bank immediately.

Step 5: Freeze Your Card If Necessary

If something doesn’t feel right, freeze your card.

I remember finding a weird charge during a meeting; instead of panicking, I froze the card through the bank app. This action gave me time to investigate without risking further charges.

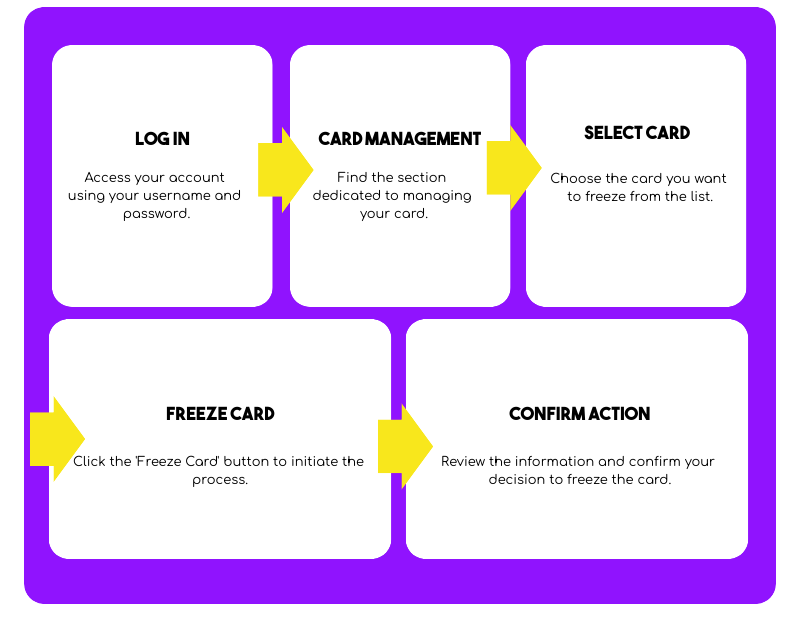

To freeze the card, follow these steps:

Your card will remain frozen until you unfreeze it by following the same procedure.

Step 6: Change Passwords

Passwords are your first line of defense. You should try a combination of passwords that are strong—Alphanumeric—and different for every account you create.

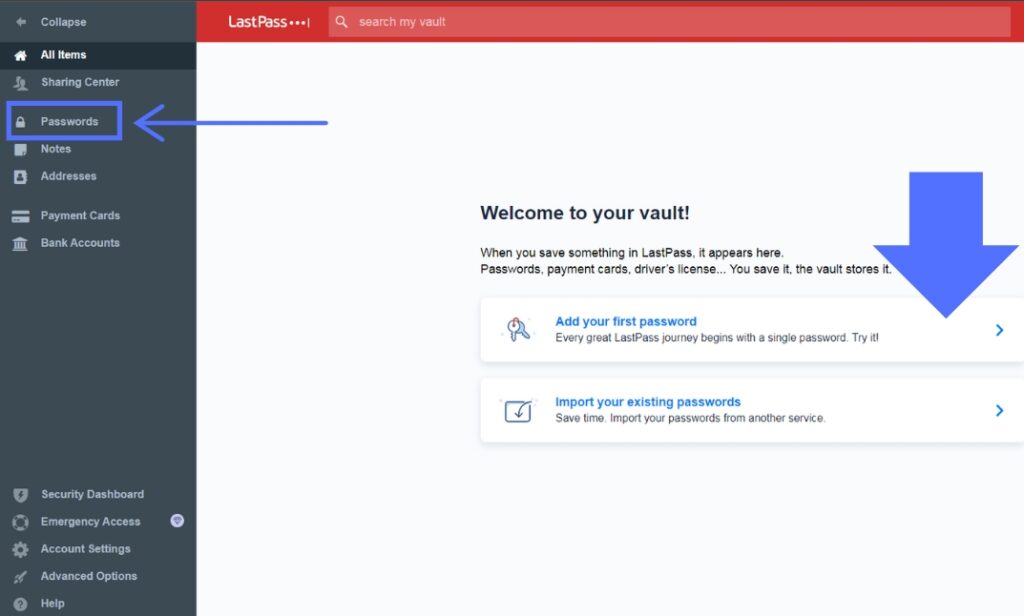

A password manager like LastPass can be helpful in managing complex passwords while keeping them secure.

To get started with LastPass, follow these steps:

Step 7: Report Suspicious Activities to Authorities

If you find a charge that doesn’t add up, contact your bank right away.

Their fraud department can investigate the charge on your behalf.

Additionally, reporting to authorities can also help prevent further instances of fraud.

Step 8: Keep Receipts for Future Reference

Keeping your receipts—both physically and digitally—can be a lifesaver when disputing charges.

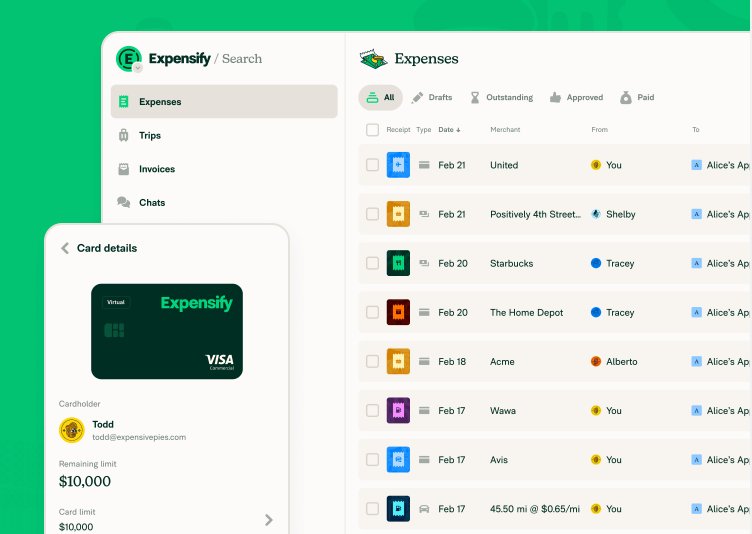

I use Expensify, a receipt scanning application that makes logging expenses almost effortless.

Expensify has changed the way I handle my finances.

Where I used to drown myself in receipts and tracking expenses, it has become so easy with scanning, categorizing, and reporting in a few simple clicks.

Step 9: Learn Fraud Prevention

Staying informed is key. Many websites, such as the Federal Trade Commission, offer free guides on detecting and preventing fraud.

Step 10: Consider Identity Theft Protection Services

Going a step further, consider subscribing to identity theft protection services like LifeLock.

These services monitor your credit for suspicious activity, providing a safety net against potential fraud.

How to Dispute a Charge

Once you’ve identified a suspicious charge, follow these steps for dispute resolution:

Additional Tips

Frequently Asked Questions (FAQs)

1) What is this charge on my credit card?

It could be a forgotten purchase, subscription renewal, or fraudulent activity. Double-check your records.

2) Why is there a charge on my credit card bank statement?

This could be due to automated bills, trial services upgraded to subscriptions, or unauthorized use of your card.

3) How can I dispute a charge?

Contact your bank, and they will guide you through the dispute process.

4) Is this charge unauthorized?

If you can’t link a charge to any purchase or service, it’s likely unauthorized. Contact your bank immediately.

5) How do I report fraudulent credit card charges?

Report directly to your bank or card issuer’s fraud department.

Key Takeaways

- Be proactive: Monitor your accounts regularly.

- Set up alerts: Watch for suspicious activity.

- Use security features: Virtual cards and spending limits add extra protection.

- Change passwords: Use strong, unique passwords with the help of a password manager.

- Stay informed: Learn about fraud prevention and consider identity theft protection services.

Disclaimer: These are general tips for preventing credit card fraud, but each individual’s situation may vary. Consult with a financial advisor for personalized advice.