Do balloon loans go on Maryland house titles? Learn how they work, their legal impact, and what it means for your homeownership.

You are sitting at the closing table, signing the paperwork for your dream home in Maryland. The terms sound perfect at first: lower monthly payments, manageable upfront costs. Then, you come across that dreaded phrase: “balloon payment.” What does this mean to you and your house title? That’s what we’re here to unpack.

Through this informative post, we go deep inside to learn all about balloon loans, their loan requirements, and what happens when the title of a house involves some problems in the state of Maryland. By the end, you shall clearly understand precisely how such kinds of loans work, including the legality in application and the specific loan requirements involved, thus helping you understand the strategies one is supposed to make. Let’s have coffee and get started.

Article Breakdown

What is a Balloon Loan?

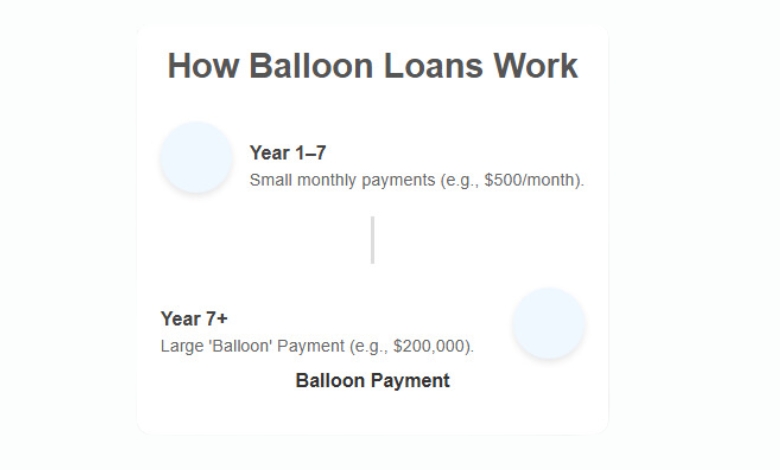

Let’s start with the basics: A balloon loan is a type of mortgage where you pay relatively small monthly payments over a fixed period, say five to seven years. Great, right? But then there’s the gotcha: At the end of your loan term, you’ll owe one big payment-the “balloon”-to pay off the remaining balance.

Why Choose a Balloon Loan?

A very common reason that people select a balloon loan is due to their low monthly payments throughout the original term. It makes more sense with this type of loan structure when a large expected windfall in income, an expected career improvement, or selling the property well before the balloon payment arrives.

Example: You purchase a house for $300,000, availing a balloon loan. You may just pay the interest or a minute amount of principal for seven years. At the end of seven years, however, you’ll still owe the remaining balance in one big lump-$200,000. It is something like if you borrowed your friend’s car for free with the understanding that in a year, you had to buy them a brand-new one.

How Balloon Loans Affect Maryland House Titles

Now, let’s talk about how this impacts your house title in Maryland. When you take out a balloon loan, the lender secures their interest by placing a lien on your property title. This lien ensures the lender has a legal claim to the property until the loan is fully paid, including that final balloon payment.

What Does This Mean for You?

- Ownership with Conditions: Even though your name is on the title, the lien means the lender can foreclose on the property if you fail to make the balloon payment.

- Refinancing Challenges: If you plan to refinance to cover the balloon payment, the lien might complicate the process, especially if property values have dropped or your financial situation has changed.

Example: Think of it as leasing a car with an option to buy. Sure, you’re driving it around town, but the dealership still owns it, until you pay off the balance.

Key Legal Insights for Maryland Borrowers

Maryland has specific laws governing balloon loans to protect borrowers from unexpected surprises. Let’s break them down.

Disclosure Requirements

Maryland law mandates that lenders clearly disclose the balloon payment terms to borrowers. This includes:

- The amount of the balloon payment.

- When it is due.

- Your rights regarding postponement or refinancing.

Postponement Rights

Here’s a silver lining: Maryland borrowers have the right to request a one-time postponement of their balloon payment for up to six months. During this time, you’ll continue making regular monthly payments, and lenders cannot charge extra fees for the extension.

Example: Let’s say your balloon payment is due in December, but your finances are stretched thin during the holiday season. Maryland law allows you to push the payment to June without penalty, giving you breathing room.

Risks and Considerations

Balloon loans can be a double-edged sword. While they offer short-term relief, they come with significant risks. Let’s explore these.

Foreclosure Risks

Failing to make the balloon payment could result in foreclosure. This is especially risky if you’re counting on selling the property or refinancing but face unexpected hurdles.

Example: Imagine the housing market dips, and your property’s value drops below what you owe. Selling to cover the balloon payment might no longer be an option.

Refinancing Challenges

Refinancing can be tricky, especially if:

- Interest rates have risen.

- Your credit score has dropped.

- The property’s value has decreased.

Pro Tip: Always have a Plan B. Whether it’s a savings account earmarked for the balloon payment or a backup refinancing option, preparation is key.

Strategies for Success

Navigating the complexities of balloon loans requires a solid strategy. Here are actionable steps to set yourself up for success.

1. Budget for the Balloon Payment

Start planning for the balloon payment from day one. Set aside a portion of your income each month in a high-yield savings account to ensure you’re ready when the time comes.

Example: If your balloon payment is $100,000 in five years, saving $1,667 per month will get you there. Think of it as a marathon, not a sprint.

2. Explore Refinancing Early

Don’t wait until the last minute to explore refinancing options. Start the conversation with lenders at least a year before the balloon payment is due.

3. Consult Experts

Whether it’s a mortgage broker, financial planner, or real estate attorney, having an expert in your corner can make all the difference.

When I bought my first home, I underestimated the complexities of refinancing. A quick meeting with a mortgage broker saved me from making costly mistakes, and gave me peace of mind.

4. Understand Your Rights

Familiarize yourself with Maryland’s laws on balloon payments, especially your right to a postponement. Knowledge is power.

Key Takings

- Balloon loans can be a valuable tool, if you’re prepared for the challenges they bring.

- While the initial lower payments might ease your financial burden, the final balloon payment is a big responsibility that requires careful planning.

- In Maryland, understanding the legal landscape is crucial. From disclosure requirements to postponement rights, the law provides safeguards to help borrowers navigate these loans.

- But at the end of the day, the success of a balloon loan hinges on your financial discipline and long-term planning.

Useful Resources:

- 5 Things to Know About Balloon Payments for Commercial Loans: This article explains the essentials of balloon payments, focusing on their structure and implications for commercial loans.

- Balloon Loan: What It Is, How It Works, Example, and Pros: A comprehensive guide on balloon loans, detailing their mechanics, benefits, and potential drawbacks.

- Handling Surprise Balloon Mortgage: What to Do?: Discusses legal and contractual issues related to unexpected balloon mortgages, with a focus on Maryland.

- Pros and Cons of a Balloon Mortgage: Analyzes the advantages and disadvantages of balloon mortgages, including interest rate comparisons.